-

1 Introduction

Recent widespread damage of oil spills in Europe suggests that the current legal and economic framework does not provide a mechanism for preventing oil spill damages.1x R.T. Carson and S.M. Walsh, ‘Preventing Damage from Major Oil Spills: Lessons from the Exxon Valdez’, 32(3-4) Oceanis: Serie de Documents Oceanograthiques 351374 (2006).

It hardly needs explanation that environmental accidents lead to huge costs for the society and, thus, they require adequate measures to prevent and compensate them. If we look at the existing tools to tackle the environmental harm from the perspective of an environmental economist, we can see a general distinction between command-and-control regulations and market-based instruments. They all play a role to control environmental pollution when, due to high transaction costs, private parties cannot bargain and address market failures.2x W. Pfenningstorf, ‘Environment, Damages, and Compensation’, 4(2) Law & Social Inquiry 347 (1979). When market decisions affect third parties (those who are not involved in that specific market transaction) by causing negative externalities, a market failure occurs. Pollution is a typical example of market failure. Actors causing negative externalities should take into account the full social costs of their production, otherwise they keep engaging in activities leading to pollution levels that would be higher than what is socially optimum. Externalities might be internalised through private negotiation or (oftener) government intervention. Indeed, pollution is considered to be the ‘fundamental theoretical argument for government intervention’. See R.N. Stavins, ‘Environmental Protection and Economic Well-Being: How Does (and How Should) Government Balance These Two Important Values?’, in J.A. Riggs (ed.), How Do Business, Government and Media Balance Economic Growth and a Healthy Environment? (2003), at 1. However, the two classes of instruments largely differ. Command-and-control tools (conventional approach)3x On the reasons why regulatory instruments became so frequently adopted to control environmental pollution, see N. Keohane, R. Revesz & R.N. Stavins, ‘The Choice of Regulatory Instruments in Environmental Policy’, 22 Harvard Environmental Law Review 313 (1998). consist of regulations to force firms and individuals to uptake a share of pollution-control burden irrespective of the costs.4x Stavins (2003), above n. 2, at 4. They include uniform standards (technology and perform-based standards).5x Design standards require the use of technologies, while performance standards determine the maximum amount of pollution that firms or individuals are allowed to emit (ibid., at 4). On the other hand, market-based instruments aim to induce firms and individuals to undertake pollution control in a more cost-effective way6x At least in theory, market-based tools to control pollution are more cost-effective because they induce behavioural changes while minimising the social costs to pursue the predetermined levels of pollution. For an in-depth view of costs of regulation versus liability, see S. Shavell, ‘Liability for Harm versus Regulation of Safety’, 13(2) The Journal of Legal Studies 357 (1984). through price signals, such as tradable permits and pollution charges.7x For an extensive review of environmental market-based instruments, see R. Stavins, ‘Experience with Market-based Policy Instruments’, in K. Mäler and J. Vincent (eds.), The Handbook of Environmental Economics (2003), at 355. Private liability laws belong to this last category since they can provide potential polluters with strong incentives (implicit prices)8x T.S. Ulen, ‘Rational Choice Theory in Law and Economics’, in B. Boudewijn and G. De Geest (eds.), Encyclopedia of Law and Economics. Volume I. The History and Methodology of Law and Economics (2000), at 790ss. to consider the consequences of their actions9x In law and economics, it is traditionally assumed that human beings take ‘rational’ decisions, meaning that people choose the options that best meet their preferences given certain expectations that they create based on the optimal amount of information that they gathered. In this way, human beings are assumed to maximise their expected utility. This predominant approach to human behaviours is called ‘rational choice theory’ and it is predominant in law and economics, although heavily debated because of several limitations. See H. Schäfer and C. Ott, The Economic Analysis of Civil Law (2004). A relatively more recent approach, the so-called ‘behavioural law and economics’, assumes instead that people do not act always rationally due to psychological biases, such as the ‘endowment effect’ for which people are willing to pay less for acquiring something (a right or a good) than what they are willing to accept for giving it up. Based on this and more psychological findings, this approach tends to support a more regulatory approach rather than believing in private market transactions. See, ex multis, C. Jolls, C.R. Sunstein & R. Thaler, ‘A Behavioral Approach to Law and Economics’, 50 Stanford Law Review 1471 (1998). and, thus, to efficiently prevent accidents.10x According to Schäfer and Ott, efficiency means that in a society it is possible to achieve the highest level of utility given the resources which are initially available and their allocation. See Schäfer and Ott, above n. 9. When deciding which among many policy options is socially preferable, there may be different approaches. For instance, the ‘Pareto efficiency’ is that state of efficiency where it is not possible to make one more person better off without making at least one other person worse off. However, Pareto-efficient situations suffer from well-known limitations; for instance there can be many Pareto-efficient situations at the same time. An alternative to Pareto efficiency is Kaldor-Hicks efficiency, for which a social state is efficient if it is no longer possible to increase the total welfare of a society. The most common criterion to choose which law is more efficient in the economic analysis of law is Kaldor-Hicks and the primary goal of the law is considered to be the maximisation of the total social welfare (S. Shavell, Foundations of Economic Analysis of Law (2004), at 2; Schäfer and Ott, above n. 9, at 47). As to the measurement of social welfare, there might be various views. Basically, it is possible to measure it in terms of money, utility or wealth. See R.A. Posner, ‘Wealth Maximization Revisited’, 2 Notre Dame Journal of Law, Ethics and Public Policy 85 (1985). Money is a more objective standard, but it suffers from decreasing marginal utility. On the other hand, utility makes impossible to make interpersonal comparisons. Unfortunately, there is no general consensus on the best way to measure welfare. Yet, it is very common to use money as a measure for ‘maximising social welfare’, given that subjective preferences can be also converted in monetary terms. See: H. Kerkmeester, ‘Methodology: General’, in B. Boudewijn and G. De Geest (eds.), Encyclopedia of Law and Economics. Volume I. The History and Methodology of Law and Economics (2000), at 386ss. According to the theory of tort law and economics, the primary goal of liability laws is therefore to induce polluters to adopt optimal levels of care and activity so that the total social costs of accidents are minimised.11x According to Calabresi, the primary function of tort law is to reduce the sum of accident costs and costs to avoid accidents (minimisation of social costs). This reduction goal then applies to three categories of costs. The first category (primary costs) concerns the costs of accidents themselves and the costs to avoid accidents; the second category includes the costs of inefficient distributions of costs within the society and the costs to spread the risk of accidents (distribution). Tertiary costs lastly refer to the cost of administering the treatment of accidents (costs of litigation, for instance). See G. Calabresi, The Costs of Accidents: A Legal and Economic Analysis (1970), at 26-27. In other words, the first aim of liability laws is the optimal deterrence of environmental accidents and not only victim compensation.12x To understand why deterrence is likely to minimise the costs of accidents and thus maximise social welfare, legal rules need to be regarded as creating implicit prices for alternative behaviours. More specifically, tort damages (or a criminal fine) represent a price for infringing the law. Given that an increase in prices normally produces a decrease in demand, an increase in legal price, e.g. tort damages, should theoretically induce potential polluters to a decrease in unlawful behaviours (Ulen, above n. 8). Knowing that a certain amount of damages has to be paid as a consequence of the accident, potential polluters will be induced to adjust their levels of activity and precaution in such a way that the additional private cost (including the probability of future damages) is lower than the additional benefit. See A.M. Pacces and L.T. Visscher, ‘Methodology of Law and Economics’, in B.M.J. van Klink and S. Taekema (eds.), Law and Method. Interdisciplinary research into Law (Series Politika, nr 4) (2011), at 95. Scholars of law and economics have been writing for years on how liability laws should be designed to induce optimal deterrence. In this article, one of the possible causes of inefficiency is addressed, i.e. the mismatch between (expected) liability and (expected) harm. Although the meaning of these terms is readily summarised in the next paragraph, it is sufficient to underline this crucial fact: if the liability falls short of the harm, the incentives to minimise the total costs of accidents are expected to be inadequate. The problem is that environmental accidents pose serious issues of uncertainty about the level of losses and these issues become clear especially when assessing damages in litigation. This is due to a number of reasons that will be illustrated in depth in this article. Although environmental economists developed methods to quantify the harm to nature, they all present pros and cons in terms of accuracy13x A central goal in the valuation of the environment is to produce accurate value estimates (see infra). Since the ‘true value’ is unobservable, like in many other disciplines, criteria need to be developed as indicators of accuracy. Reliability and validity are the common criteria of accuracy in environmental economics. Reliability has to do with variance and erratic results, whereas validity refers to unbiased results. and costs. Possible inaccuracies are likely to undermine the possibility to achieve optimal deterrence of environmental accidents through liability, hence leading to more pollution. The aim of this article is therefore to determine whether, from a perspective of law and economics,14x For the sake of clarity, this article adopts the mainstream approach to the economic analysis of law, i.e. the ‘rational choice theory’ (see above n. 9). Alternative approaches (e.g. the behavioural one) would deserve separate examination and they are not considered here. there exists a methodology of environmental damage assessment that can be regarded as sufficiently accurate but also cost-effective to induce optimal deterrence in environmental liability laws. In order to respond to this question, some basic notions of environmental tort law and economics, such as ‘accident’ and ‘expected liability’, are first introduced. Then, the theory of tort law and economics is reviewed to clarify how damages should be assessed to achieve optimal deterrence. Building on this theoretical framework, existing techniques to value natural resources in environmental economics are illustrated, with special regard to their advantages, shortcomings and use in real cases. Thereafter, they are compared in view of pursuing deterrence in an efficient way. In conclusion, despite the inexistence of a general consensus in economics for a fully accurate and cost-effective methodology of environmental damage assessment, it can be argued that there is possibly room for improving the deterrent effect of environmental liability laws by relying on the recent ecosystem service approach to damage assessment.

-

2 Starting from the Economic Meaning of Terms

From an economic perspective, the term ‘accident’ generally refers to the harmful outcome (i.e. loss of utility) of events that neither the injurer nor the victim wanted to occur, although they might have affected its likelihood and severity.15x S. Shavell, Economic Analysis of Accident Law (1987), at 1. ‘Accidents’ occur without being intentionally induced and between parties that are not previously bound by a contractual relationship.16x For instance, the decision of the victim to buy a house close to a polluting factory might raise the probability of the accident. Moreover, they hold a peculiar reciprocal nature, meaning that both parties (injurer and victim) are responsible for the resulting harm.17x R. Coase, ‘The Problem of Social Cost’, 3 The Journal of Law and Economics 1, at 13 (1960). In environmental cases, injurers (e.g. the polluting companies) unintentionally cause harmful effects that could have been reduced by adopting ex ante optimal decisions on the levels of care and activity. Other important terms to define are those of ‘liability’ and ‘expected liability’. With ‘liability’ (or damages) we mean the amount of monetary compensation for which the injurer is legally liable towards the accidents’ victims, whereas the ‘expected liability’ (or expected damages) is the loss multiplied by the probability of suffering that loss.18x Shavell (1987), above n. 15, at 6. According to the theory, injurers are expected to behave optimally if the liability (damages) equals (or is approximately the same as) the harm.19x Shavell (2004), above n. 10, at 236. However, under the negligence rule the optimal magnitude of damages can be even higher or lower compared to the magnitude of harm, because injurers can avoid liability by taking due care (as long as the due care is set optimally). For this reason, law and economics scholars agree that only under a strict liability regime economic efficiency requires that the injurers pay for all the losses they caused. See: R. Cooter 1984, ‘Prices and Sanctions’, 84(6) Columbia Law Review 1523, at 1542 (1984); W.M. Landes and R.A. Posner, The Economic Structure of Tort Law (1987), at 64; R.A. Posner, Economic Analysis of Law (1986), at 176; A.M. Polinsky, An Introduction to Law and Economics (1983). On the other hand, even under negligence a too low level of expected liability might induce injurers to prefer being liable rather than taking due care. If, for instance, there is more than one possible level of harm (stochastic loss) and the liability equals the actual level of harm, also the expected liability will match the expected harm20x Shavell (2004), above n. 10, at 236. The underlying assumption according to the rational choice theory is that parties have an optimal amount of information about the level of harm and they know in advance if the accident may result in more possible levels of harm. and parties’ behaviours will be optimal.21x L. Kaplow and S. Shavell, ‘Economic Analysis of Law’, in A.J. Auerbach and M. Feldstein (eds.), Handbook of Public Economics Vol. 3 (2002), at 1661. The next section will delve more into the economic rationale underlying this theory.

-

3 The Economic Relevance of Accuracy in Environmental Damage Assessment

Incentives to minimise accidents’ costs are theoretically optimal only where the expected liability equals or is approximately the same as the expected harm.22x This is specifically true under strict liability (see above, n. 19) and for unilateral accidents, i.e. when it is assumed that only the injurers’ behaviours (and not the victims’ ones) can influence accident risks. See also Kaplow and Shavell (2002), above n. 21. The economic rationale for the match between expected liability and expected harm is that polluters tend to invest in care up to the point where the marginal cost of risk reduction (or precaution) equals the marginal benefit (avoided loss or expected liability). The logical consequence is that if the liability is lower than the harm (not all social costs are internalised), potential polluters will underinvest in care, which turns out into underdeterrence and higher likelihood of accidents. Conversely, if the liability exceeds the loss resulting from the accident, potential polluters will invest in care more than what is socially desirable, which means for instance a too low level of activity.23x For more detailed examples, see Kaplow and Shavell (2002), above n. 21. As a consequence, deviations between the level of (expected) liability and the level of (expected) harm will distort the incentives to minimise the total social costs of accidents.24x However, negligence rules represent an exception to that, see above n. 19. It thus makes sense to understand why deviations would occur and how much accuracy is socially desirable. Possible causes of divergence25x A. Endres, Environmental Economics: Theory and Policy (2010). include information asymmetries between parties about the magnitude of harm, courts’ errors, low levels of polluters’ assets and difficult-to-estimate components of harm, such as non-pecuniary losses. Non-pecuniary losses are components of losses which have no economic price or value on financial markets (i.e. health damages).26x S.D. Lindenbergh and P.P.M. van Kippersluis, ‘Non Pecuniary Losses’, in M. Faure (ed.), Tort Law and Economics, Vol. 1, Encyclopedia of Law and Economics (2009), at 215. Nevertheless, they are regarded as compensable with money in tort law,27x Ibid., at 217 for references to studies that show the importance of nonpecuniary losses in awarding tort damages. hence raising either fundamental (why compensate non-pecuniary losses) or more practical questions (how to value non-pecuniary losses) that have been largely debated in law and economics. Set aside the ‘why’ that has been already examined (deterrence purposes)28x Awarding compensation for nonpecuniary losses is socially desirable to give parties the right behavioural incentives. ‘All costs of accidents should be charged to those who could avoid them by taking precautions’, see M. Adams, ‘Warum kein Ersatz von Nichtvermogensschaden?’, in C. Ott and H. Schäfer (eds.), Allokationseffizienz in der Rechtsordnung (1989), at 213. and the ‘how’29x For a review of approaches to nonpecuniary losses referred to personal injuries, see Lindenbergh and van Kippersluis, above n. 26, at 223ss. that will be the object of the next section, it is now important to understand how much accuracy is socially worthwhile, considering that parties in liability lawsuits hold opposite private interests.30x ‘The primary objective of the plaintiff is to collect as much as possible and that of the defendant is to pay as little as possible’ (L. Kaplow and S. Shavell, ‘Accuracy in the Assessment of Damages’, 39(1) Journal of Law and Economics 191, at 191 (1996)). Also, consider that what will be said is applicable both to accidents resulting in trials and to settlements (ibid., at 198).

A first largely agreed point in tort law and economics is that there is no one optimal rule for all situations.31x J. Arlen, ‘Tort Damages’, in B. Bouckaert and G. De Geest (eds.), 2 Encyclopedia of Law & Economics (2000), at 682. The efficiency of damage awards necessarily relies on the specific circumstances. Arlen proposes five main criteria32x Ibid. to classify and analyse these situations: harm to replaceable versus irreplaceable goods; unilateral versus bilateral risk; strict liability versus negligence; individual versus vicarious liability; lastly, further issues: information costs, uncertainty, judgement proof33x ‘Parties who cause harm to others may sometimes turn out to be judgement proof, that is unable to pay fully the amount for which they have been found legally liable.’ From: S. Shavell, ‘The Judgement Proof Problem’, 6 International Review of Law and Economics 45 (1986). problems. For instance, a strict liability regime requires that the injurers pay for all the losses they caused, whereas this is not true under negligence.34x See above n. 19. Suffice it to say, the full compensation of losses should not be seen as a goal in itself but as a means to achieve optimal prevention taking into account the specificities of the case at hand.

Another important point emphasised by law and economic scholars is that, as a general rule, liability should not grossly and systematically deviate from accidents’ social costs.35x M. Faure and L.T. Visscher, ‘The Role of Experts in Assessing Damages – A Law and Economics Account’, 2(3) European Journal of Risk Regulation 376, at 378 (2011). Slightly inaccurate assessments are acceptable provided that the expected liability is on average correct.

The third point is that accurate assessments of damage levels increase the administrative costs to handle related cases.36x Ibid., at. 379. In order to save costs in litigation, abstract assessments might help and they should be preferred to the extent that they provide a good approximation of real losses and that the saved costs (benefit) outweigh the costs of small mistakes (accidents’ costs that go uncaptured).37x Ibid. Consistently, difficult-to-estimate components of harm would be correctly replaced by average estimates if the cost of their precise estimation outweighs the benefit of their inclusion (for instance, they are too small compared to the harm).38x L.T. Visscher, ‘Tort Damages’, in M.G. Faure (ed.), Tort Law and Economics, Vol. 1, Encyclopedia of Law and Economics (2009), at 160. This is also applicable to the non-use values of nature (see next section).39x S. Shavell, ‘Contingent Valuation of the Nonuse Value of Natural Resources’, in J.A. Hausman (ed.), Contingent Valuation: A Critical Assessment (Contributions to Economic Analysis), Vol. 220 (1993), at 371.

The fourth point is that it is important to take into account the information held by injurers when they decide on precautions.40x Kaplow and Shavell (1996), above n. 30. If injurers know exactly the level of harm they will cause when taking decisions on care and activity levels, accuracy in damage assessment influences their behaviours and it makes economic sense for the court to measure harm accurately.41x Ibid., at 194 (proposition 1), but this is true ‘if it is not too costly for the harm to be observed by courts’. Conversely, if injurers lack knowledge in advance (like in many environmental accidents), very accurate assessments in litigation would increase the administrative costs without providing injurers with better incentives (social loss).42x In the words of Faure and Visscher: ‘A more accurate damage assessment ex post would therefore not necessarily result in better behavioural incentives ex ante’ because polluters adapt their behaviours to the ‘estimation’ of the losses they expect to cause (see above n. 35, at 379). Lastly, it is also true that accuracy incentivises injurers to learn about the harm before they act, for that they can adopt a level of care in line with the expected harm.43x Kaplow and Shavell (1996), above n. 30. Then, ex post accuracy in assessing damages is socially desirable if injurers can anticipate the magnitude of loss ex ante and it is socially optimal for the injurers to get that piece of information.

To conclude and going back to the original question (how much accuracy is socially worthwhile), broadly speaking, injurers should pay for all the harmful effects of their actions (including pecuniary and non-pecuniary losses) under strict liability. Rough estimates have to be preferred if they considerably lower administrative costs and they serve to assess components of loss that are not big enough to overweigh the costs to assess them.44x If the law totally excludes these elements from the magnitude of liability, a social loss might occur. Indeed, the injurer will not invest in optimal care to avoid the loss that nobody is legally entitled to claim. As a consequence, part of the magnitude of harm is likely to remain unprevented unless other tools are set down by the legal system to respond to the undeterred negative externality (regulations, criminal fines, taxes, etc.). Rough estimates should be also preferred if injurers lack ex ante information about the loss. These conclusions carry over to the difficult-to-estimate components of environmental losses that will be analysed in the next section. -

4 The Challenge of Valuing Natural Resources in Economics

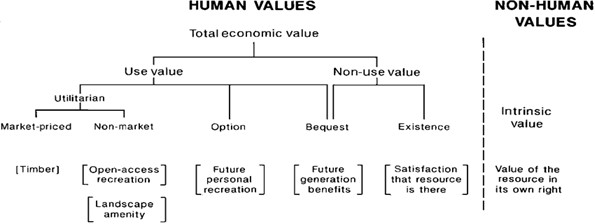

Having reviewed the fundamental scholarship of law and economics on the accuracy of damages, the next step would be to understand why issues of inaccuracy may occur when dealing with environmental damages. It might be helpful to begin from a general understanding of how values are assessed in economics. Value has been the topic of different disciplines: philosophy, anthropology, sociology, psychology and economics. Because of that, it is not surprising that value has many meanings.45x T.C. Brown, ‘The Concept of Value in Resource Allocation’, 60 Land Economics 231, at 231 (1984). Brown classified all values into preference-related and non-preference-related (i.e. values in mathematics). Preference-related values include: intrinsic, instrumental, functional, held and assigned values; they all involve a human preference, i.e. ‘the setting by an individual of one thing before or above another thing because of a notion of betterness’ (ibid., at 234). When it comes to ‘environmental’ values, philosophers specifically examined the notion of intrinsic values,46x In the words of Brown (above n. 45, at 234): when the valued entity is an end in itself and its value is independent of any other entity. In the words of M. Lockwood (see ‘Humans Valuing Nature: Synthesising Insights from Philosophy, Psychology and Economics’, 8(3) Environmental Values 381, at 384 (1999)): ‘it is a widely shared intuition for which an accepted theory to support it is yet to be developed’. psychologists developed methods to assess how much people believe in intrinsic values and economists tried to measure economic values that could be used to take decisions on how to manage natural resources.47x For an overview of the contributions from all these disciplines on human values for natural resources, see the seminal work by Lockwood, above n. 46, at 382. He drew on Brown (above n. 45) and J. O’Neill, ‘The Varieties of Intrinsic Value’, 75(2) The Monist 119 (1992). In the words of Brown (above n. 45, at 231): ‘Economic measures of value are species of the genus assigned value, which belongs to the family value’. There is indeed a fundamental distinction between held and assigned values that Brown describes in depth (above n. 45, at 233). Held values refer to principles and ideals that are important to people; they can be instrumental values, such as generosity or courage, and terminal values, such as happiness and freedom. There is a large body of literature, especially in psychology, on held values and how they may influence human behaviours and environmental concerns. For instance, held values have been grouped into clusters (anthropocentric, ecocentric, egoistic, socio-altruistic, etc.) and clusters give a certain orientation to human values for the environment. See for more references on held values: E. Seymour, A. Curtis, D. Pannell, C. Allan & A. Roberts, ‘Understanding the Role of Assigned Values in Natural Resource Management’, 17 Australasian Journal of Environmental Management 142 (2010). Yet, held values do not say anything about social preferences for specific natural resources or particular changes in environmental quality (K. Segerson, ‘Valuing Environmental Goods and Services: An Economic Perspective’, in P.A. Champ, K.J. Boyle & T.C. Brown (eds.), A Primer on Nonmarket Valuation (2017) 1, at 6). Conversely, assigned values express the relative importance of an object to a group or individual in a given context, by implicit or explicit comparison (Brown, above n. 45, at 232). Therefore, economic valuation techniques developed over the past four decades focused on assigned values because they enable the understanding of how people trade-off environmental values (within the rational choice theory). See M.A. Freeman, The Measurement of Environmental and Resource Values: Theory and Methods (1993). For more references and discussion about assigned values, see Segerson (in this footnote, at 9ss). Economics defines the environment as valuable in two senses: in terms of its direct impact on individual utility and in terms of its impact on production.48x N. Hanley, ‘The Economic Value of Environmental Damage’, in M. Bowman and A. Boyle (eds.), Environmental Damage in International and Comparative Law (2002), at 27. Environmental values can be also measured through (monetary) impacts on production, i.e. through the impact of environmental changes on productive factors and, in turn, on profits. Yet, environmental damage assessment techniques mainly focused on the loss of individual utility and, thus, the measure of production losses is not taken into account in this article. Utility is an economic concept used in neoclassical economics to measure the well-being of people; it refers to happiness or satisfaction of individuals when consuming products.49x However, the utility theory of value is just one of the possible approaches to values, which draws on the basic idea that values are given by the interaction between individual preferences and productive abilities. Another possible approach would be to measure values through the labour needed to produce goods (this is the typical approach in classical economics). For instance, people derive utility from buying certain goods and, thus, the value of goods is given by their change in utility (marginal utility). This is also applicable to environmental goods.50x For a short history of the utility theory applied to the environment in the western belief system, see S. Parks and J. Gowdy, ‘What Have Economists Learned about Valuing Nature? A Review Essay’, 3(C) Ecosystem Services e-01 (2013). People can indeed derive utility from carrying out activities in nature, such as birdwatching or swimming. As a consequence, the level of individual utility can increase or decrease if the quality of the environment changes. If an accidental event pollutes a beach, visitors will not be able to swim and they will see their utility reduced as a consequence of the accident. This change in utility can be regarded as a measurement of the environmental value and, namely, of the ‘use value’ of the environment. However, even people not using natural resources might suffer a loss of utility due to the accident. This is because we value our future possibility of using that environment or we care about the fact that future generations will benefit from the same possibility. More precisely, economists refer to these as ‘non-use’ or ‘passive-use’ values of environmental goods and services.51x Some economists keep criticising passive-use values by questioning their existence as well as the need for special assessment techniques (the so-called ‘contingent valuation’, see infra). Nevertheless, environmental policies to preserve natural resources void of use values (e.g. the Amazon rain forest) reveal the relevance of non-use values. Drawing on this wider approach, in 1985 Boyle and Bishop laid the foundation of the concept of total economic value (TEV) of the environment.52x K.J. Boyle and R.C. Bishop, ‘The Total Value of Wildlife: A Case Study Involving Endangered Species’, 278711 1985 Annual Meeting, August 4-7, Ames, Iowa, American Agricultural Economics Association, (1985). Figure 1 provides an easy-to-read taxonomy with some examples:53x Source: I.J. Bateman, A.A. Lovett & J.S. Brainard, Applied Environmental Economics. A GIS Approach to Cost-Benefit Analysis (2003), at 2.

The total economic value of nature

As can be seen above, the TEV includes both ‘use values’ and ‘non-use values’ (or passive-use values) within the category of human values for the environment. Use values54x The ‘use value’ differs from the ‘exchange value’. The former relates to the benefit of using natural resources independently from the fact that they are traded in the market. The latter (exchange value) is basically the price or the commercial value. Say and Ricardo were the first scholars who, in the beginning of the 19th century, pointed out that natural resources may have a high use value even if they have no exchange value (price). Neoclassical economists in the 20th century further emphasised use values. This distinction explains the apparent paradox of goods with a high use value and a very low exchange value (e.g. water) and goods with a low use value and a very high exchange value (e.g. diamonds). For a historical overview of economic schools of thoughts on the value of natural resources, see E. Gómez-Baggethun, R. de Groot, P.L. Lomas & C. Montes, ‘The History of Ecosystem Services in Economic Theory and Practice: From Early Notions to Markets and Payment Schemes’, 69(6) Ecological Economics 1209 (2010). are based on the actual, future or possible use (option value) of environmental goods, whereas non-use values55x The origins of this notion date back to the end of the 1960s. In 1967 John Krutilla published the paper titled ‘Conservation reconsidered’ in the American Economic Review. His aim was to bring about a change in the field of conservation economics by shifting the traditional focus to natural areas that were not efficiently provided by the market and they thus risked being underprovided in the future (e.g. national parks). From the perspective of Krutilla, these amenities needed to be protected in spite of missing use values but in view of their future recreational value. He never talked about a total economic value but his lesson is deemed as foundational in the field of modern environmental economics. The development of non-market valuation techniques to measure passive-use values exploded in the years that followed his paper. See J.V. Krutilla, ‘Conservation Reconsidered’, 57(4) American Economic Review 777 (1967). In 2003 Freeman defined non-use values more broadly as all values that are not measurable by revealed preference methods; in this way difficulties in defining what is ‘use’ are avoided. refer to the social preference for the mere existence (existence value)56x The existence value means that people gain utility from knowing that a natural resource exists even if the individuals expressing their values have no actual or planned use for themselves or anyone else. Therefore, they would be willing to pay for its preservation. or for the possible/actual use from future generations (bequest value). Intrinsic values, which are independent from human preferences, are by definition not encompassed by the TEV, although they may influence non-use values.57x In this article, we do not enter into the debate on intrinsic values and how to account for them. Suffice it to say, the notion has been mainly discussed in the philosophical literature rather than in economics. Indeed, it is much unclear from the perspective of the utility theory how people would trade off intrinsic values with other values. For this reason, the TEV traditionally does not include intrinsic values, but it is possible to elicit them through stated preference methods.

Within this traditional framework, the next step is to understand how to assess the various values. Since in neoclassical economics values are linked to utility, valuation techniques aim to measure utility changes. Let us now assume that individuals enjoy the same level of utility when a reduction in the quantity of one good is compensated by an increase in the quantity of another good, that may be anything but in practice it is often money.58x This is a basic assumption in the utility theory of value and in line with the rational choice theory. See R.C. Bishop and K.J. Boyle, ‘Reliability and Validity in Nonmarket Valuation’, in P.A. Champ, K.J. Boyle & T.C. Brown (eds.), A Primer on Nonmarket Valuation (2017) 463, at 465. The obvious consequence of this common assumption is that a measure of the trade-off between the object of valuation and something else in exchange can be regarded as the ‘true value’ of the good whose value needs to be assessed. With environmental changes, the problem is that it is often impossible to directly infer their value from market prices. How to measure the value of a polluted beach after an oil spill if there is no market price to look to? Environmental goods that are not bought and sold in the marketplace, such as beaches, wildlife, rivers and fresh air, are known in economics as non-market goods59x There are a lot of goods falling in the category of environmental goods: air quality, water quality, amenities such as a good view on nature, etc. Environmental economics includes in this category everything for which people may have preferences. They differ from ordinary goods because there is no market for them and, thus, it is not easy to build a demand curve and deduce their value from the interaction between demand and supply. They belong to the larger category of public goods (goods that are non-rival, i.e. they can be simultaneously consumed by everyone, and non-excludable, i.e. nobody can be excluded from consuming them by, for instance, paying a price). See C.D. Kolstad, Environmental Economics (2000), at 289ss. and the tools developed to measure their value are called non-market valuation techniques. Their goal is to measure the ‘true value’ for a change in the quality of environmental goods and services.60x Bishop and Boyle define the ‘true value’ or WTP for a change in environmental quality, as ‘the maximum income that a consumer would be willing to give up to have the same utility as before after the environmental change takes place’. See Bishop and Boyle, above n. 58, at 465.

Before introducing them, why they were developed needs to be clarified. According to Segerson, the first techniques to value natural resources in the US appeared in the 1950s and they were used by federal agencies in benefit-cost analyses of water projects, such as dam constructions.61x K. Segerson, ‘Valuing Environmental Goods and Services: An Economic Perspective’, in P.A. Champ, K.J. Boyle & T.C. Brown (eds.), A Primer on Nonmarket Valuation Second Edition (2017) 1, at 4. In the years that followed economists further refined and improved those techniques, since new laws, such as the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) of 198062x The CERCLA and the Oil Pollution Act (OPA) of 1990 triggered the improvement of non-market valuation techniques because they allowed accidents’ victims to sue for damage compensation. and other regulations, required either to estimate compensation for damages after environmental accidents or to assess costs and benefits of environmental policies.63x The cost-benefit analysis is a popular technique aimed at identifying, quantifying and weighing the costs and benefits of projects and policies, including the environmental impacts (costs and benefits).

Having said that, we can now go back to the practical valuation of non-market goods when they are not traded. Absent prices, environmental economists developed similar concepts equally applicable to environmental goods in order to measure their demand curve: the maximum amount of income that an individual would be willing to give up in order to have more of another good and keep the same utility level as before (compensating welfare measure or willingness to pay, WTP)64x In principle, the good used as term of reference could be anything. In practice, economists have generally used money to measure values. and the (minimum) amount of additional income that an individual would need to gain in order to give up something that he already owns and keep the same utility level as before (equivalent welfare measure or willingness to accept, WTA).65x Much attention in the economic scholarship revolved around the difference in size between the two measurements, given by the fact that the WTP is bound by income (it is influenced by the income of the valuator), that people value losses more than gains because they are more willing to pay to maintain their status quo rather than paying to improve it (prospect theory). See D. Kahneman and A. Tversky, ‘Prospect Theory: An Analysis of Decision under Risk’, 47(2) Econometrica 263 (1979). Moreover, the absence (or scarcity) of good substitutes for environmental quality might bring to a higher WTA compared to the WTP, because people would ask more money to accept a higher risk of degraded environment rather than what they would be willing to pay for a reduced risk of it. For a deeper understanding of all these issues, see W.M. Hanemann, ‘The Economic Theory of WTP and WTA’’, in J. Bateman and K.G. Willis (eds.), Valuing Environmental Preferences: Theory and Practice of the Contingent Valuation Method in the US, EU, and Developing Countries (2001), at 42. Which one to use depends on the assignment of property rights. An example can be useful. Imagine that we want to assess the value of an environmental loss caused by an accident. The ex ante WTP is the maximum amount of money that individuals would be willing to give up for introducing measures that avoid the occurrence of accidents (and related losses) and for keeping their utility as before the accidents, whereas the WTA is the minimum money that individuals would be willing to accept in order to tolerate a lower value of the environment. Whether to adopt the WTA or the WTP depends on the entitlement prior to the accident: if people had the right to enjoy a pre-loss level of utility from the environment, then it would be appropriate to measure the WTA.66x E.S. Goodstein and S. Polasky, Economics and the Environment (2004), at 78. The authors explain that if people think that clean air or clean water belong to them, then the value for a reduction of environmental quality would be better expressed by the willingness to be compensated for their degradation. For this reason, survey studies should correctly measure the WTP for private goods and the WTA for common goods. But, how to measure the WTP (or the WTA) in practice? The next section will explain in more detail which techniques of non-market valuation have been developed to assess use and non-use values of the environment. -

5 The Methods of Nature Valuation in Environmental Economics

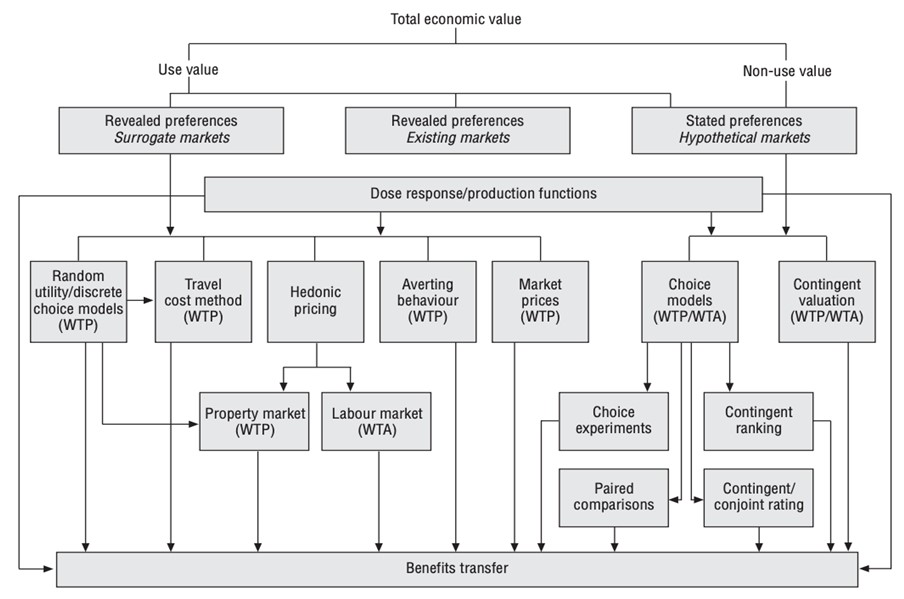

As stated earlier, environmental goods and services are usually not traded in the marketplace. Indeed, it rarely happens that goods, like timber or fruits, can be bought and sold. Only in these relatively few cases, it is possible to elicit the value of the environment from prices. This type of valuation technique is thus called market-based. If instead there is no market price for natural resources, then it is necessary to resort to non-market valuation methods. The methods of non-market valuation in environmental economics are grouped into two main categories: revealed and stated preferences. Revealed preference methods indirectly imply values from observed behaviours in surrogate markets (e.g. house market) or existing markets (e.g. how many people buy the ticket to visit a park), whereas stated preference methods directly extract the maximum WTP or the minimum WTA from answers to survey questions (hypothetical market). The main difference between the two classes is not only the technique, but also the components of TEV which they can capture. Revealed preference methods only capture use values, while stated preference techniques are ideally able to capture both use and non-use values. However, each existing method captures use or non-use values limited to a specific category of goods (e.g. hedonic pricing only looks at goods with a price, such as houses). Figure 2 provides a synthesis of the relationships between TEV, methods and proxies:67x Source: D. Pearce, G. Atkinson & S. Mourato, Cost-Benefit Analysis and the Environment. Recent Developments (2006), at 88. Under this framework, production functions play a central role because there is a link between policy change, a change of the environment and some responses. For instance, a change of air quality (dose) would bring about a response in the number of sick people (output). Therefore, production functions should be taken into account to determine the TEV.

Total economic value

Some observations based on the figure above are needed. Non-use values, which are highly relevant for natural resources with few or no substitutes (e.g. a unique natural place), can only be estimated through stated preference methods (questionnaires). Revealed preference methods cannot elicit non-use values for the simple reason that non-use values are not linked to behavioural changes68x In the words of Pearce and Mourato, a ‘behavioural trail’ (ibid., at 86). in the marketplace (e.g. a change in the demand or the supply). Whether a valuation method is likely to elicit both use and non-use values of the environment is pretty relevant from a perspective of law and economics. Let us assume that an environmental good has been damaged and it held a huge non-use value compared to the use value (e.g. a natural area used not used either for recreation or for other goals). In this case, neither prices nor revealed preferences would capture its total value. As a consequence, liability laws are expected to send to potential polluters wrong incentives of precaution (and activity), hence causing underdeterrence and pollution beyond optimal levels. A stated preference method would instead allow to obtain estimates that should be closer to the ‘true value’69x See above n. 60. of the lost environment, provided that questionnaires have been properly designed to ensure reliable and accurate answers (see Section 5.3.2). Therefore, the latter methods have to be preferred if one wishes to internalise the full cost of environmental accidents. Revealed and stated preference methods are called of primary valuation and they differ from benefits transfer, which refers to the process of applying the results of other studies (primary valuation) to assess similar natural resources. Their validity has been highly debated but they can be considered valid under certain circumstances and they allow to save time and money.

In addition to use and non-use values, further issues need to be taken into account in view of minimising the total social costs of accidents, such as the reliability, the validity and the same costs of valuation. A central goal in the valuation of the environment is indeed to produce accurate value estimates. Reliability and validity are the common criteria of accuracy in environmental economics. Reliability has to do with variance and erratic results, whereas validity refers to unbiased results. These concepts will be clarified in the following subsections which briefly illustrate the advantages and shortcomings of each category of valuation techniques, followed by examples of their uses in practical cases. Within each category, the focus will be on the main methods that have been employed by judges in liability cases, rather than tackling all the existing non-market valuation techniques. For this reason, methods like choice models and averting behaviour will not be examined.5.1 Market-Based Approaches

When environmental goods and services can be traded in markets, such as fruits and timber, it is possible to infer their values directly from market prices.

Taxonomy of market-based valuation techniques

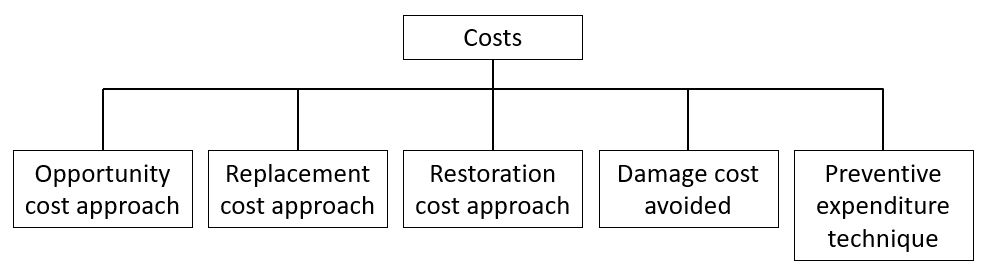

To be more precise, market-based approaches may look at either the cost side or the benefit side.70x This is a traditional classification from IIED (International Institute for Environment and Development), ‘Economic Evaluation of Tropical Forest Land Use Options: A Review of Methodology and Applications’ (1994).

Cost-based valuation is based on the assumption that expenditures on producing and maintaining environmental goods or services provide net benefits and these benefits correspond to the original level of benefits. It requires the elaboration of hypothetical scenarios that respond to the question: what would be the cost to bear if the environmental good or service had to be artificially recreated? Figure 3 illustrates the cost side of market-based approaches.71x The table can be found in the notes prepared by A.N.A. Ghani for the lecture on ‘Market-based Techniques’, at 4. See www.blogs.ubc.ca/apfnet04/module-5/topic-1-market-based-techniques/.

The opportunity cost approach derives from the idea that the opportunity cost of unpriced uses (e.g. forest conservation) can be inferred from the foregone income of other uses (e.g. forestry).72x For instance, the time spent harvesting may be valued in terms of foregone rural wages (opportunity cost of labour). See E.B. Barbier, M. Acreman & D. Knowler, ‘Economic Valuation of Wetlands. A Guide for Policy Makers and Planners’, Ramsar Convention Bureau, at 42 (1997). Note that the information about opportunity costs can be then obtained also through stated or revealed preferences (hypothetical or surrogated markets).

The replacement cost approach looks at the expenditures incurred to replace the impaired natural resources with substitutes. The underlying idea is that replacement costs provide a measure of the minimum WTP to keep receiving a certain benefit (assuming that individuals have correct information about the damage).

The restoration cost approach, like the preventive expenditure method, estimates the cost of activities to maintain a certain level of enjoyment or output, including the relocation of individual activities, households and firms or adjustments to maintain an activity in the existing location.

The damage cost avoided infers the value of the environment from the costs incurred to avoid an environmental damage. Yet, not all agree that the damage cost avoided is a cost-based approach because it is based on the assumption that the cost of damage is a measure of value.73x Barbier et al., above n. 73, Appendix 3, at 11.

The preventive expenditure technique or mitigation cost approach looks at the costs that households are willing to pay to prevent future environmental damages and keep stable their existing level of utility. Presumably, individuals are willing to spend up to the point where the costs equal the benefits derived from a protected environment. Their WTP can be then inferred through stated preferences (contingent valuation or CV) or revealed preferences (from similar events in the past).

Market-based valuation techniques from the benefit side look instead at the market value (price) or the change in income of productive factors. The underlying rationale for using prices is that if natural resources physically contribute to the production of other commodities or services traded in markets (e.g. fishing, hunting and farming), changes in ecological functions (improvement or deterioration of environmental quality, e.g. water quality) may affect the quantity or price of certain goods.74x A.M. Freeman, ‘Valuing Environmental Resources under Alternative Management Regimes’, 3(3) Ecological Economics 247 (1991). Also: A.M. Freeman, J.A. Herriges & C.L. Kling, The Measurement of Environmental and Resource Values. Theory and Methods (2003), at 259. On the other hand, changes in income can be used to measure the value of the environment given that there is a correlation between environmental pollution, sicknesses (or premature death or increased medical expenses) and the income of workers. Conversely, increases in wages can be used to measure the benefits of pollution control.5.1.1 Advantages

Market prices are usually considered to provide accurate information on the value of natural resources since they embed market preferences and marginal costs of production, which means data from actual markets. This may have three well-known advantages. First, data on prices, quantities and costs are easy to obtain, less resource-intensive and not expensive. Secondly, market prices reflect the actual WTP for costs and benefits that are traded, so they are considered to be sufficiently accurate to reflect the ‘true value’ of nature. Thirdly, these data are generally regarded as sufficiently objective and thus more reliable than other tools to elicit social preferences.

5.1.2 Limitations

The main limitation of these approaches is that they are applicable to the extent that markets exist and data on prices or costs are available. More often, choices on environmental goods and services are not observable in market transactions because they are public goods and usually not traded in markets.75x In economics, public goods are those commodities or services which are available for the whole society, non-excludable (there is no technology available to exclude others from using the same good) and non-rivalrous (individual consumption does not reduce the quantity available for others). The fact that we breath air does not exclude others from breathing and does not consume the quantity available for the others. For instance, even if we value bats and we would be willing to pay for their conservation,76x It might be interesting to know that the faith of bats has been at the forefront of a recent case before the Hawaii Supreme Court due to a contentious wind farm. According to the plaintiffs, a local community for which bats hold cultural and spiritual values, the windfarm project did not follow the standards set by the law to protect endangered species, hence causing the death of 51 bats per year. How to weigh the social benefit of a windfarm with the social cost represented by the ecological and cultural loss of 51 bats per year if they have no price? For more details, see this short commentary with useful references: www.jindalsocietyofinternationallaw.com/post/bat-fatalities-at-kahuku-windfarm-making-a-case-under-international-environmental-law. there is no market where we can express our preference for their preservation.

The second limitation is that, even if market prices are available, they might be distorted by policy interventions (e.g. subsidies or taxes),77x It is quite well known that subsidies distort market prices and they thus interfere with the conduct of economic agents. Technically, subsidies can reduce the marginal costs of recipients or raise their marginal revenues. In this way, subsidies provide the ability to produce at lower costs, so that recipients enjoy a competitive advantage and they can increase the production. As a consequence, prices might inefficiently increase. An exception is given by subsidies for Research and Development (R&D). This category of subsidies addresses a typical market failure, since the provision of knowledge created by programs of R&D is publicly available. For this reason, the private revenues would not equal the costs and its provision would be lower than efficient. See R. Diamond, ‘Privatization and the Definition of Subsidy’, 11 Journal of International Economic Law 649 (2008). monopolies,78x Monopolies without government interventions lead to higher prices and a consumer welfare lower than efficient levels (more welfare for the monopolistic producer). seasonal variations, etc. This limitation can be overcome by adjusting prices (so-called ‘efficiency shadow prices method’) so that they reflect the true WTP. Yet, shadow pricing might face further criticism due to the artificial nature of data, the fact that it is based on assumptions and it might suffer from inaccuracies.79x A. Smith, ‘Shadow Price Calculations in Distorted Economies’, 89(3) The Scandinavian Journal of Economics 287, at 302 (1987).

Last but not least, prices only refer to the preferences of those who use non-market goods and with whom there is a clear demand link (see above the distinction between value of use and value of exchange). However, there are cases when the demand is unidentifiable and this does not mean that people do not value non-market goods.80x N.E. Flores, ‘Conceptual Framework for Nonmarket Valuation’, in P.A. Champ, K.J. Boyle & T.C. Brown (eds.), A Primer on Nonmarket Valuation Second Edition (2017), at 44. Simply, market-price approaches cannot capture non-use values by those who do not use environmental goods (so, there is no demand link) but would be still willing to pay for their conservation or improvement.

Further limitations specifically relate to some approaches. For instance, Barbier warned that the replacement cost method should be used with caution because it is unsure whether the benefits of the replacing resource are equal to the benefits of the original damaged resource if data on the original ecological functions are not available.81x Barbier et al., above n. 73, Appendix 3, at 10. Moreover, Daily pointed out that direct relationships between resources and economic outputs are often difficult to estimate.82x G.C. Daily, ‘Ecosystem Services: Benefits Supplied to Human Societies by Natural Ecosystems’, 2 Issues in Ecology 1 (1997). Additional issues of inaccuracy are given by the fact that restoration costs might exceed the benefits of the original resources if data on the baseline are missing and/or restoring previous conditions might be difficult. Likewise, it is unlikely that relocated environmental commodities can provide the same benefits of the lost ones in the original location.83x Barbier et al., above n. 73, Appendix 3, at 10.5.1.3 Practical Application

Nowadays the restoration cost approach is the most widespread method to quantify environmental damages in liability lawsuits. Its use became compulsory in the EU after the entry into force of the European Directive on Liability (ELD)84x Directive 2004/35/CE of the European Parliament and the Council of 21 April 2004 on environmental liability with regard to the prevention and remedying of environmental damage, OJ L 143/56. The Directive entered into force on 30 April 2004. and it is one of the allowed – but most used – methods under US law.85x The legislative history of ‘natural resource damage assessment’ (NRDA) in the United States dates back to the Trans-Adriatic Pipeline Authorization Act of 1973. This act, for the first time, empowered national authorities to sue compensation for damage caused by oil spills. The so-called Superfund legislation (the Comprehensive Environmental Response, Compensation and Liability Act, CERCLA of 1980) extended this possibility to the case of environmental damage caused by the release of hazardous substances (in addition to the discharge of oil). Later, the US Department of Interior adopted some guidelines to implement the law. All methods of damage assessment are allowed (market-based, revealed and stated preferences), provided that they are feasible and reliable for a particular incident, cost-effective, performed at a reasonable cost and they avoid double counting. Particularly, it has been applied in the largest oil spill in the US, the Deepwater Horizon (DWH) case. The accident happened in the northern Gulf of Mexico (64 km from mainland Louisiana) in April 2010 with the explosion and subsequent fall of the British Petroleum’s (BP) drilling platform (DWH), which ultimately led to the release of 200 million gallons of oil for a period of 87 days, affecting 1,300 miles of shoreline and coastal wetlands, an incredible number of birds, sea turtles, marine mammals, fishes, etc. Hundreds of claims and litigations were filed against BP. In October 2010, five Gulf States filed civil claims for natural resource damages and civil liability. In January 2015, a federal court established that BP was legally responsible for the discharge of 3.19 million barrels into the Gulf for failure to perform safety tests. In April 2016, BP agreed to pay $ 20.8 billion in settlements, much less than the estimated costs of clean-up ($ 61.1 billion).86x NOAA 2019. This amount is based on the assessment of the liable party (BP). Regarding more specifically natural resource damages, it took several years to find an agreement between BP and the States.87x D. Gilbert and S. Kent, ‘BP to Pay Out $18.7 Billion to Settle Spill’, Wall Street Journal A1 (2015). In the end, BP incurred almost $ 9 billion environmental costs (based on the restoration cost approach) and $ 39 billion litigation costs for environmental claims.88x Y.G. Lee, X. Garza-Gomez & R.M. Lee, ‘Ultimate Costs of the Disaster: Seven Years after the Deepwater Horizon Oil Spill’, 29 Journal of Corporate Accounting & Finance 69, at 72 (2018). Assessing the costs of post-spill restoration was defined as ‘a monumental task’ because the values of all affected environmental services and goods had to be estimated, the different economic methods of economic valuation ‘reconciled’ and, also, the costs of clean-up started to get bigger and bigger as time went by.89x B.P. Wallace, T. Brosnan, D. McLamb, T. Rowles, E. Ruder, B. Schroeder, L. Schwacke, B. Stacy, L. Sullivan, R. Takeshita & D. Wehner, ‘Overview Effects of the Deepwater Horizon Oil Spill on Protected Marine Species’, 33 Endangered Species Research 1 (2017). Alternative estimates were proposed but not applied, such as $ 145 billion90x See Lee et al., above n. 89. and $ 2 trillion based on annual sales of coast businesses.91x Dun and Bradstreet Bureau of Labor Statistics, ‘2010 Deepwater Horizon, Oil Spill Preliminary Business Impact Analysis for Coastal Areas in the Gulf States’ (2010). Concerning the restoration cost approach, it raised criticism among ecologists in connection with the principle of ecological equivalence, especially when applied to wetlands (as in the DWH).92x E.B. Barbier, ‘Coastal Wetland Restoration and the “Deepwater Horizon” Oil Spill’, 64(6) Vanderbilt Law Review 1819 (2019). This principle refers to the capacity of restored environments to reproduce the ecological structures provided by the natural resources in the pre-accident state. The main point of criticism was that little attention was paid to site location within the surrounding landscape, natural patterns of plant communities, wetland hydrological regimes and long-term ecological functions.93x Ibid. In other words, long-term economic benefits resulting from restored natural resources had to be better considered rather than just the actual costs of restoration for equivalent ecological functions. Ecologists further stressed that relying on post-crisis restoration assessments means to make the success of restoration depending on the money available from government and corporations94x Also, note that the national fund (Oil Spill Liability Trust Fund) can cover only up to $1 billion per accident, of which no more than $500 million can compensate natural resource damages (1/60th than the needed amount in the DWH accident). with the risk that long-term restoration goals are replaced by short-term goals of elected politicians or appointed corporate directors.95x Overreliance on restoration may turn into excessive postcrisis approaches and less effort in pre-accident prevention and conservation. See more on this view in R.L. Wallace, S. Gilbert & J.E. Reynolds, ‘Improving the Integration of Restoration and Conservation in Marine and Coastal Ecosystems: Lessons from the Deepwater Horizon Disaster’, 69(11) BioScience 920, at 923ss (2019).

5.2 Revealed Preference Methods

When prices of environmental goods and services are not available, but there are markets closely related to them, revealed preference methods can be applied. These techniques are based on the observation of preferences shown, i.e. ‘revealed’, in actual market transactions which have a correlation with the natural resource to value. Two main methods are used to elicit revealed preferences: travel cost models (TCMs) and hedonic pricing (HP).

TCMs are used to value recreational uses of natural resources, such as fishing, rock climbing, boating, swimming and hunting.96x The earliest travel cost models date back to the 1950s and they followed the method proposed by Hotelling. They measure visitation rates for geographic zones defined around single recreation sites. See H. Hotelling, ‘An Economic Study of the Monetary Valuation of Recreation in the National Parks, Washington’, U.S. Department of the Interior (1949). The underlying insight is that the cost of the trip to reach a site corresponds to the individual’s price for recreation (lower bound). Therefore, individuals reveal their WTP for recreation through the number of trips they do and the site they choose to visit. Changes in the demand function for recreation can indeed provide a measure of changes in preferences for the quality or quantity of environmental goods and services. The use of TCM has been largely motivated by the need to conduct benefit-cost analyses of environmental regulations or for damage compensation after accidents.97x ‘Economists have been concerned with measuring the economic value of recreational uses of the environment for more than 50 years’ (G.R. Parsons, ‘Travel Cost Models’, in P.A. Champ, K.J. Boyle & T.C. Brown, A Primer on Nonmarket Valuation Second Edition (2017), at 187ss). Most research in the 1960s aimed at valuing per-trip values in order to support conservation versus development of large water resource projects (at least in the United States). In the late 1970s and in the 1980s, the interest moved to valuing quality changes at recreation sites induced by policies willing to improve the quality of the environment. In the 1980s much research was conducted on beach uses and recreational fishing in Alaska. See N.E. Bockstael, W.M. Hanemann & I.E. Strand, ‘Measuring the Benefits of Water Quality Improvements Using Recreation Demand Models’, Report presented to the U.S. Environmental Protection Agency. College Park: University of Maryland (1984); N.E. Bockstael, M.W. Hanemann & C.L. Kling, ‘Estimating the Value of Water Quality Improvements in a Recreational Demand Framework’, 23 Water Resources Research 951 (1987); R.T. Carson, W.M. Hanemann & T.C. Wegge, ‘Southcentral Alaska Sport Fishing Study’, Report prepared by Jones and Stokes Associates for the Alaska Department of Fish and Game, Anchorage, AK (1987); R.T. Carson, W.M. Hanemann & T.C. Wegge, ‘A Nested Logit Model of Recreational Fishing Demand in Alaska’, 24 Marine Resource Economics 101 (2009). Economists started to look at many more recreational activities (fishing, swimming, boating, climbing, hiking, hunting, skiing, etc.). During the past two decades, models have been further improved and refined. The latest models (Kuhn-Tucker) try to integrate seasonal and site choices into a unified utility framework.

HP is used to estimate the implicit prices of characteristics over heterogeneous or differentiated products (distinct varieties of one product).98x L.O. Taylor, ‘Hedonics’, in P.A. Champ, K.J. Boyle & T.C. Brown (eds.), A Primer on Nonmarket Valuation Second Edition (2017), at 235. Although popularised by Griliches in the 1960s, the coining of the term ‘hedonic’ dates back to a 1939 article by Andrew Court. Court was an economist working for the Automobile Manufacturers’ Association in Detroit from 1930 to 1940. Examining automobile prices indices, he noticed that passenger cars serve so many different uses that one single most important characteristic cannot be identified. Therefore, prices cannot be compared by applying a simple regression method. He proposed instead to employ single composite measures. In his work, hedonic specifically refers to an index of ‘usefulness’ that combines the relative importance of various characteristics (braking capacity, horsepower, etc.). Hedonic indexes can be then compared. For a description of Court’s work, see A.C. Goodman, ‘Andrew Court and the Invention of Hedonic Price Analysis’, 44 Journal of Urban Economics 291 (1997). In his words: ‘Hedonic price comparisons are those which recognize the potential contribution of any commodity, a motor car in this instance, to the welfare and happiness of its purchasers and the community’ (ibid., at 292, footnote 2). Imagine that a product is sold in one market but characteristics vary in such a way that there are distinct product varieties. It is possible to indirectly observe the monetary trade-off which individuals are willing to make by observing the difference in price between two product varieties which vary only by one characteristic (e.g. two identical houses, but one has an additional room).99x The utility theoretic framework needed to build the demand function for characteristics of heterogeneous products has been developed by Rosen in a seminal paper. See: R. Rosen, ‘Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition’, 82 Journal of Political Economy 34 (1974). For this reason, HP is an indirect valuation method that infers values from observable market transactions. In the environmental domain, it is commonly applied to the housing market. Let us take an example. If there are two identical houses in front of two different lakes (one with improved water clarity), the price differential determined by the increasing demand for the house in front of the lake with better water is the implicit price consumers are willing to pay for that environmental amenity (water clarity). Implicit or hedonic prices allow therefore to elicit the WTP for that specific environment.5.2.1 Advantages

The first advantage of revealed preference methods is that there is broad agreement among researchers on the steps that need to be followed to achieve minimal accuracy in estimating true values. The TCM is considered to be a high-ranking tool among revealed preference techniques and there is widespread confidence on its validity,100x Bishop and Boyle (2017), above n. 58, at 489. whereas HP is one of the most popular methods thanks to the minimal data requirements and its easy empirical implementations.101x Taylor, above n. 99, at 285. Scholars emphasise the existence of a clear procedure that starts from the search of a surrogate market close to the environmental goods and services to be valued. The procedure follows with the choice of the appropriate method (TCM or HP). Then, the needed data are collected according to the relative procedures102x In TCM, recreation surveys are designed, sent around and analysed according to a precise step-wise guide (Parsons, above n. 98, at 203). In HP, there are two subsequent steps: collection of marginal price information and then estimation of the demand function by combining information on prices and data on household characteristics (Taylor, above n. 99, at 237). in order to build the demand function.103x A typical set of questions in TCM surveys is: 1) trip count and location; 2) last trip: 3) stated-preference question; 4) respondent and household characteristics. Subsequently, the value of a marginal change in the quality or quantity of environmental good is deducted from the demand function. Lastly, values are aggregated and discounted. For the HP, information on sales prices is always readily available, with considerable savings of time and costs. Moreover, data acquisition costs have been decreased, hence making both stages of HP cheaper.104x Taylor, above n. 99, at 285.

5.2.2 Limitations

There are various limitations to revealed preference methods. Studies on TCM have been much concerned with accuracy issues, starting from the 1960s.105x Bishop and Boyle (2017), above n. 58, at 487. Yet, such research has never been explicitly revolving around the topics of reliability and validity.106x As already said above at footnote n. 13, reliability and validity are criteria to assess the accuracy. Reliability has to do with variance and erratic results, whereas validity refers to unbiased results. Apparently, Bishop and Boyle made a first attempt in this regard and their conclusions shall be applicable to all revealed preference methods.107x Bishop and Boyle (2017), above n. 58, at 487. Regarding reliability, it seems that: ‘using recreation-participation data with long periods of recall could tend to increase the variance of reported participation and hence reduce the reliability of the travel cost method, all else being equal’.108x Ibid., at 488. In other words, the time of recall (i.e. the time to reconstruct the behaviour on which respondents to surveys are supposed to report) might make the method less reliable with long recall periods. Therefore, for reliable data it is essential to ensure short recall periods. As to the validity side, there are still a number of partially unresolved issues that have been not directly addressed. Parsons identifies a list of ‘soft spots’ that need to be improved in TC modelling, such as the current way of measuring time, overnight trip modelling, multipurpose trips, integration of site choices with trip frequency, the inclusion of more welfare-revealing choices, the error introduced by the recall bias and, finally, more integration with stated preferences studies.109x Parsons, above n. 98, at 225. Another important aspect is that most of the research on TCM ignores dynamics in decision-making (intertemporal substitutions) that would allow people to substitute sites over time or to base current decisions on expectations about future trips. Most models consider instead individual trip choices day by day over a season independently of decisions on future trips. Consideration of interdependencies between different trip choices would indeed require more complex ways of gathering data, more surveys and, in general, higher costs.110x For instance, people should receive reminders to respond to several seasonal surveys. Furthermore, trip costs are considered to be given but they can be also the result of subjective choices.111x For instance, current models use the behaviour of those with higher travel costs in order to predict the behaviour of those with lower costs in case the price of visits increases. Yet, people might choose to live closer to a recreational site and this approach would underestimate their preferences. See Bishop and Boyle (2017), above n. 58, at 489. Another issue is the ‘recall bias’, occurring when people report visiting sites more frequently than they actually do. The validity of the TCM might be considerably reduced by all these issues. In order to offset possible biases and ensure validity, it is important to carefully follow all the well-established steps of the method and to clarify all the assumptions in advance. It has been also warned in the literature that travel cost studies may give higher values than stated preferences studies, hence raising the need for more research on convergent results.112x See Bishop and Boyle (2017), above n. 58, at 491. In addition to the limitations related to accuracy, revealed preferences require the existence of surrogated markets and, if data are not already available, the process of gathering good-quality data might take time and costs. Lastly, it needs to be considered that revealed preferences cannot capture non-use values and, thus, the total value of natural resources with high non-use would not be accurate (even on average).

5.2.3 Practical Application